This week’s Torah portion was Beshalach, which tells the story of the Israelites’ escape from Egypt, including the crossing of the Red Sea. The Torah reading includes the Song of the Sea (Mi Chamocha), which was sung by the women after the escape; it is one of the only two readings where the congregation traditionally rises (the other is the Ten Commandments). One of our members has chanted this portion for many years (it’s her birthday portion), and she did so again today.

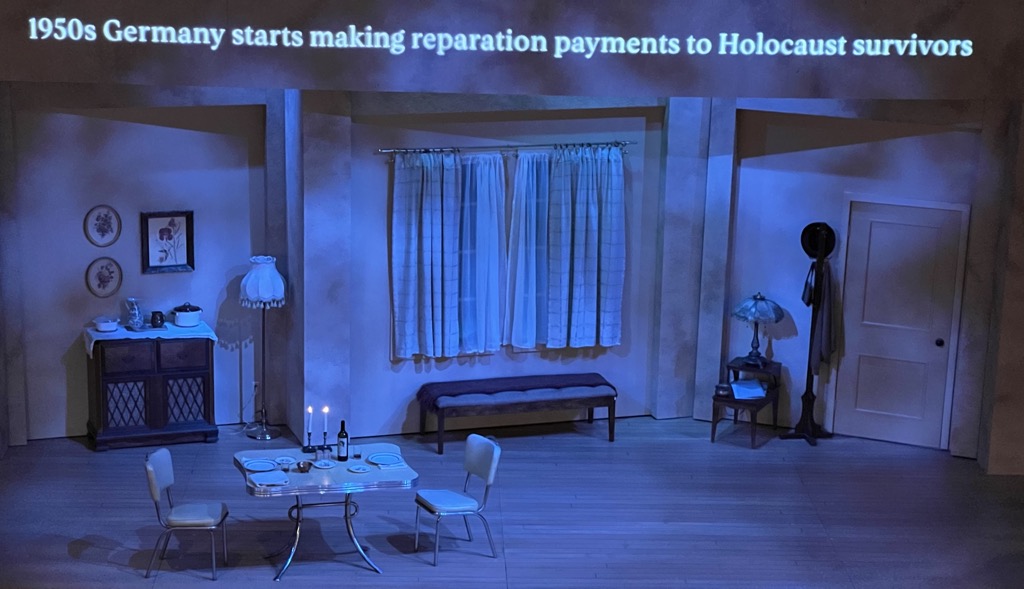

After services, we went to Mountain View to see Theaterworks‘s production of Ali Viterbi’s In Every Generation, which follows a Los Angeles family through three Seders, in 2019, 1954, and 2050, as well as showing them soon after the Exodus in 1416BCE. The play was a bit uneven – it took me a little while to figure out who was who (I guess it would have helped to read the program first), but once I got the characters and their relationships sorted out, I enjoyed it, and hearing the women in the cast sing the Song of the Sea as part of the play just after hearing it at Temple was an interesting coincidence. I’m not sure how much I would have gotten out of the play if I weren’t Jewish – there wasn’t a lot of explanation!

We came home just before the rains hit and I finished our taxes, despite a bug in TurboTax which caused the IRS to reject my submission at first. I had some “non-qualified compensation” which is reported on a W-2 form. In past years, it’s been treated like any other W-2 (salary) income; this year, the IRS changed the processing to move that kind of income to a different spot on the return, which confused me when I reviewed the numbers until I figured it out. TurboTax got that part right, but it also duplicated the income on the W-2 it submitted to the IRS, so the numbers didn’t add up and the return bounced. Fortunately, I was not the first one to run into the problem and the TurboTax forum suggested a work-around – go into the W-2 and delete the bogus number, then resubmit. It worked, and I’m done!